Title (): Introduction to Cryptocurrency in Japan: A Compreh2025-12-10 14:20:07

Introduction to Cryptocurrency in Japan

Japan has emerged as one of the leading countries in the world for cryptocurrency adoption and regulation. With a growing number of exchanges, innovative blockchain projects, and a government that's open to embracing digital currencies, Japan has created a vibrant ecosystem for financial technology. This guide aims to explore the key aspects of cryptocurrency in Japan, including its history, popular currencies, regulatory environment, security measures, challenges faced by the industry, and potential future developments.

The History of Cryptocurrency in Japan

The history of cryptocurrency in Japan dates back to 2014 when the Bitcoin exchange Mt. Gox, headquartered in Tokyo, made headlines due to a massive hack that resulted in the loss of approximately 850,000 Bitcoins. This incident raised concerns over the security and regulation of virtual currencies in the country.

In the wake of this crisis, the Japanese government recognized the need for regulatory oversight. In 2016, Japan's Financial Services Agency (FSA) began implementing regulations for cryptocurrency exchanges, establishing a licensing system to ensure that these platforms adhere to security and transparency standards.

By 2017, Japan had embraced Bitcoin as a legal method of payment, further accelerating its adoption. The progressive stance of the Japanese government, along with the entry of various international exchanges, has led to a significant boom in cryptocurrency trading within the country.

Popular Cryptocurrencies in Japan

While Bitcoin remains the most popular cryptocurrency in Japan, a number of other altcoins have gained traction as well. Ethereum, Ripple (XRP), and Litecoin are notably prominent in the Japanese market.

Ethereum, known for its smart contract capabilities, is often used in various decentralized applications (dApps) created in Japan. Ripple has seen significant adoption due to its focus on banking partnerships and payment solutions for remittances, which are pivotal in a country that sees a large amount of remittance flow.

Litecoin, much like Bitcoin, was designed to provide faster transaction confirmation times. Japanese investors appreciate such features as they look for efficiency in their trading experiences. Many exchanges in Japan now list numerous tokens, reflecting the diverse interests of investors.

Regulatory Environment for Cryptocurrency in Japan

The regulatory framework for cryptocurrency in Japan has been designed to foster innovation while ensuring consumer protection and financial stability. The FSA's licensing system has become a cornerstone of Japan's cryptocurrency landscape.

To obtain a license, exchanges must comply with strict requirements including anti-money laundering (AML) measures, securing customer funds, and having appropriate risk management systems in place. This regulatory clarity has attracted a host of domestic and international crypto exchanges to operate legally within Japan.

In addition to exchanges, initial coin offerings (ICOs) are also under scrutiny in Japan. The FSA requires companies wishing to conduct ICOs to register and disclose their business plans to investors, further enhancing transparency and trust in the market.

Security Measures in the Cryptocurrency Sector

Security remains a significant concern for cryptocurrency users. Following the Mt. Gox incident, there has been a heightened awareness of the need for robust security measures among exchanges and users alike.

Exchanges in Japan have adopted industry-best practices, including multi-signature wallets, cold storage for the majority of funds, and rigorous user authentication processes. Furthermore, many exchanges now offer insurance policies to protect customers against hacks or losses, enhancing consumer confidence.

On the individual level, users are encouraged to employ security practices such as two-factor authentication and hardware wallets to safeguard their digital assets. Education around cybersecurity is also becoming more prevalent, as seminars and online resources help to equip users with knowledge on how to protect their investments.

Challenges Facing the Cryptocurrency Industry in Japan

Despite Japan's forward-thinking approach to cryptocurrency, the industry faces several challenges. One significant concern is market volatility, which poses risks for investors and can lead to regulatory intervention.

Another challenge is the lack of consumer awareness about the cryptocurrency market. While adoption is growing, many individuals remain skeptical or uninformed about the benefits of utilizing cryptocurrencies for payment or investment. Efforts to educate the public are essential for sustained growth in the sector.

Additionally, the global nature of cryptocurrency trading means that Japanese exchanges face competition from international platforms, which may offer lower fees or different trading pairs. This can challenge domestic exchanges to innovate continually to retain their user base.

The Future of Cryptocurrency in Japan

The future of cryptocurrency in Japan appears promising as technology and regulatory frameworks continue to evolve. The commitment of the government to embrace blockchain technology indicates a willingness to innovate further in the financial sector.

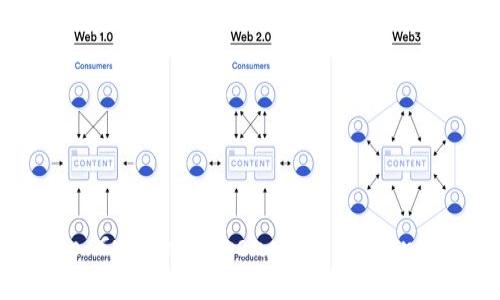

Japan is also witnessing the rise of decentralized finance (DeFi), with several projects aiming to provide financial services in a more open and inclusive manner. As the DeFi ecosystem grows, it could reshape the traditional financial landscape within the country.

Moreover, Japan's proactive stance on central bank digital currencies (CBDCs) has sparked discussions about the potential implementation of a digital yen. This could pave the way for more integration of digital currencies in everyday transactions.

Frequently Asked Questions About Cryptocurrency in Japan

1. How is cryptocurrency taxed in Japan?

Taxation on cryptocurrency in Japan can be a complex issue. The National Tax Agency (NTA) in Japan categorizes cryptocurrencies as miscellaneous income, which means that any profits made from trading are subject to income tax. The tax rate can vary depending on an individual's income bracket, ranging from 15% to 55%.

Japan requires individuals to report their cryptocurrency earnings, and failure to do so can lead to penalties. It's important for traders to keep detailed records of their transactions, including dates, amounts of cryptocurrencies bought and sold, and the corresponding yen values at the time of the transaction.

For those who are considering investing in cryptocurrencies, consulting with a tax professional familiar with Japanese tax law is advisable to ensure compliance and to understand the tax implications of their trades.

2. Are there specific regulations for ICOs in Japan?

Yes, Japan has specific regulations governing initial coin offerings (ICOs). These regulations were introduced to protect investors and ensure that companies conducting ICOs provide clear disclosures about their business models. Companies wishing to launch an ICO must register with the Financial Services Agency (FSA) and provide detailed information regarding the project's objectives, team members, and intended use of funds.

There are also rules preventing fraudulent activities, ensuring that investors' interests are safeguarded. The FSA encourages companies to adopt best practices in their fundraising campaigns, which may include implementing robust AML measures and ensuring transparency throughout the process.

With these regulations in place, investors can gain a greater level of confidence when considering participation in ICOs, knowing that these offerings are subject to government oversight.

3. What are the most popular exchanges for trading cryptocurrencies in Japan?

Japan has several popular cryptocurrency exchanges, each offering a variety of trading pairs and features. Some of the most well-known exchanges include Bitflyer, Coincheck, and Binance Japan.

Bitflyer is one of Japan's largest exchanges, catering to both beginners and professional traders with its user-friendly platform and advanced trading options. It provides access to a wide range of cryptocurrencies, making it a favored choice among users.

Coincheck gained popularity after being hacked in 2018, but it has since worked to enhance its security measures and restore its reputation in the market. The platform has a simplified interface, making it an excellent option for newcomers to cryptocurrency trading.

Binance Japan, a subsidiary of the globally recognized Binance exchange, offers a variety of cryptocurrencies and advanced trading features. Its global reputation and extensive offerings have attracted many Japanese users looking for a comprehensive trading experience.

4. What role does blockchain technology play in Japan's financial sector?

Blockchain technology is significantly influencing Japan's financial sector, driving innovation and enhancing transparency in various domains. Financial institutions are increasingly exploring the potential of blockchain to improve their internal processes and offer new services.

For instance, banks are leveraging blockchain for secure and efficient cross-border payments, reducing transaction times and costs. Additionally, the technology is being utilized in supply chain finance, enabling more transparency and traceability in transactions between different parties.

Furthermore, Japan is witnessing a rise in blockchain startups that are focusing on developing decentralized applications (dApps) for various industries. The government's positive stance on blockchain research and development encourages investment and collaboration between tech companies and financial institutions.

Overall, blockchain technology is set to play a crucial role in shaping the future of Japan's financial ecosystem, driving efficiency and trust in transactions across the industry.